Download

Abstract

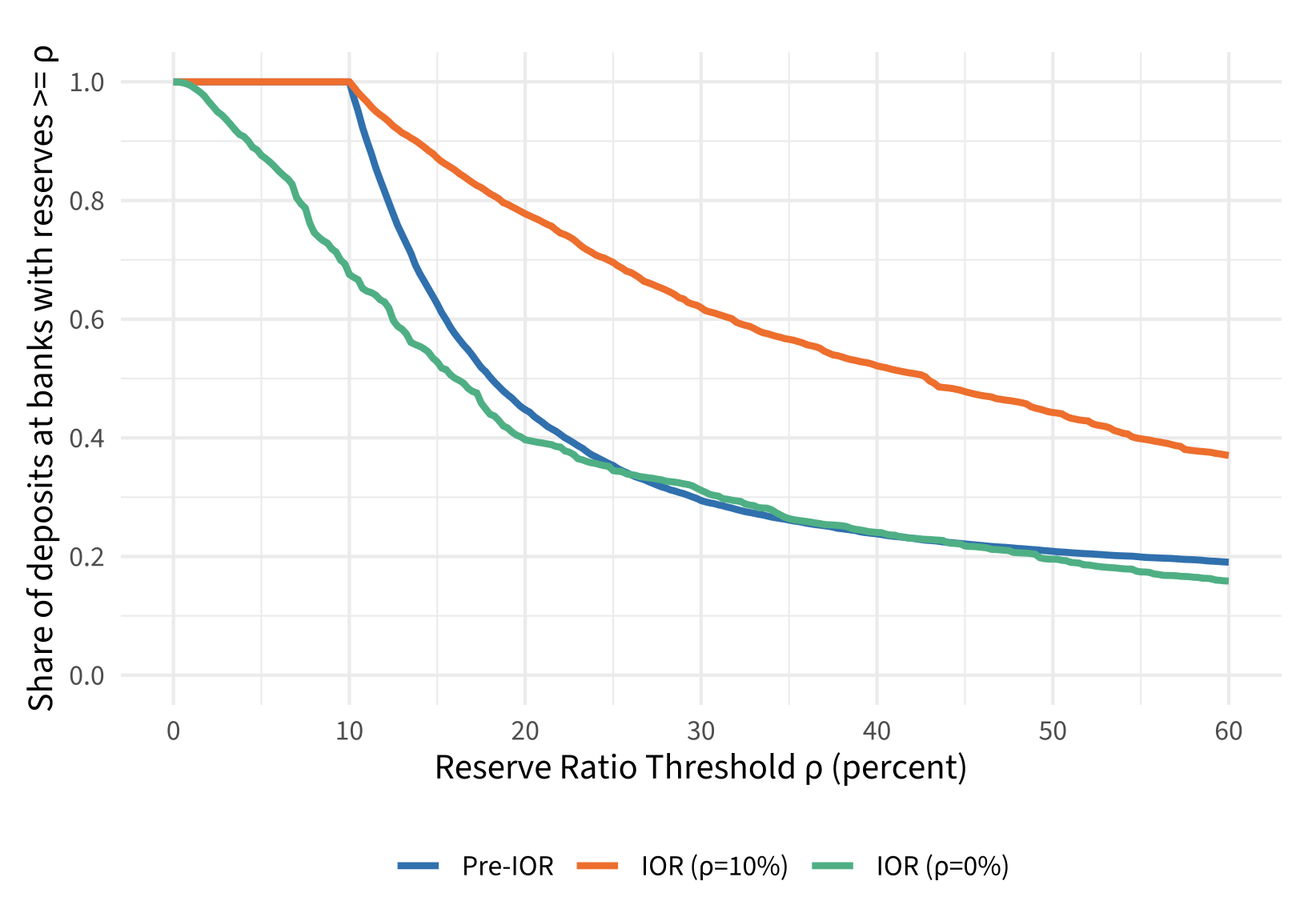

This paper documents a striking disconnect between aggregate and bank-level reserve holdings in the post-2020 U.S. banking system. While recent system-wide reserves equal $57%$ of deposits—suggesting ample buffers—$30%$ of deposits sit at banks with less than $10%$ reserve ratios. I develop a two-condition test showing reserve requirements impose no tax only when banks earn market rates on reserves or hold excess reserves exceeding requirement increases. Despite the excess reserve condition appearing satisfied in aggregate, the bank-level evidence reveals a “hollow buffer” where this quantity condition fails heterogeneously across institutions. This disconnect means the Bailey-Friedman deposit tax, seemingly eliminated by interest on reserves since 2008, would immediately reactivate for nearly one-third of deposits if requirements were reinstated while reserves earned below-market rates, as occurred for much of 2024. The concentration of reserves implies requirement changes or remuneration adjustments create sharply discontinuous effects rather than smooth responses. These findings challenge the aggregate “ample reserves” characterizations and have implications for monetary policy implementation and macroprudential design.

Currently Under Review

Figure 3. Deposit-weighted survival by regime

Citation

Pusateri, Nicholas R. 2026. “Hollow Buffers in U.S. Banking: The Hidden Distribution of Deposit Taxation.” Working Paper. URL: https://nicpusateri.com/hollow

@article{pusateri2026hollow,

title={Hollow Buffers in U.S. Banking: The Hidden Distribution of Deposit Taxation},

author={Pusateri, Nicholas R.},

journal={Working Paper},

year={2026},

url={https://nicpusateri.com/hollow},

}